Bitcoin vs. the Banks: Balaji Srinivasan's Million Dollar Prediction Shakes the Financial World

Will the bailout of Silicon Valley Bank lead to a mass adoption of Bitcoin? What does this mean for the United States economy, cryptocurrency, and the average Joe

Deja Vu,

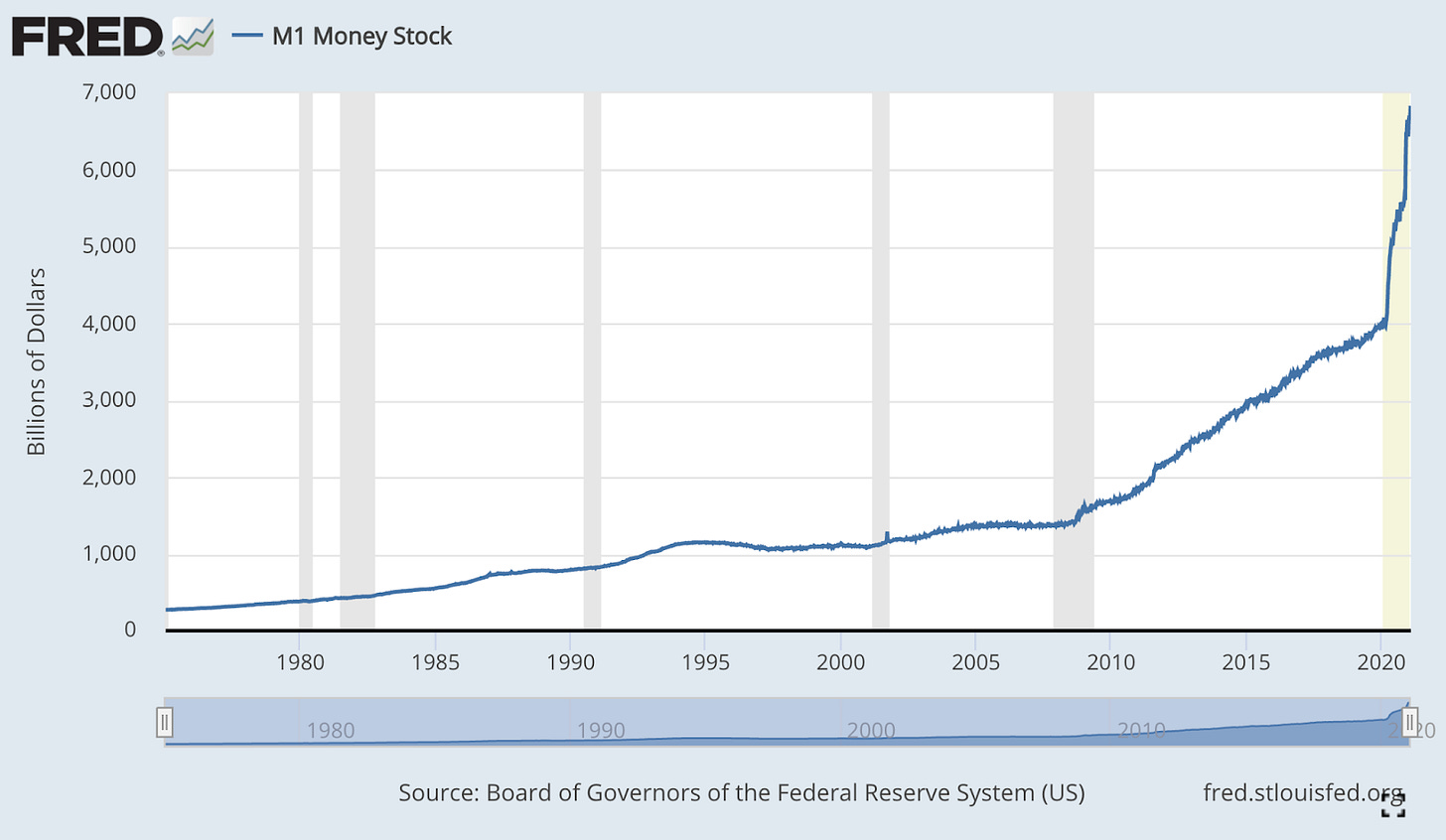

The 2008 financial crisis was the spark that led to the creation of Bitcoin. Distrust in the banks, government, and people forced Satoshi to create a form of digital currency that wasn’t at the will of the elites. It being a store of value, digital gold, means of exchange, etc has been debated into exhaustion. One thing for sure is that now more than ever we need it. With the collapse of Silicon Valley Bank and Signature Bank we feel something eerily similar to 2008. Large banks around the world as well such as Credit Suisse and Deutsche Bank are wavering. Ramifications of how the United States Federal Reserve responded to the pandemic are now starting to shine through. Massive amounts of dollars were created and once again the policy just like 2008 was quantitative easing. Cable news and mainstream media are once again manipulating the public with jargon and speculation on why this is really happening. It’s very simple and a tale we have heard before. Banks took too much risk and now have to realize their losses.

Federal reserve printed more money inflation went up -> to get inflation down they raise interest rates -> value of bond holdings go down -> do not have enough liquidity to cover depositors money

Fingers are being pointed at everyone from venture capitalists, individual depositors, regulators, and bankers. A scapegoat can be painted on any one of these figures but it was the risk management inside of Silicon Valley Bank and their inability to hedge against rising rates risk and the federal government.

Government bailout,

Let’s get the first debate out of the way by people saying that this is not a bailout. “When you have people who were going to take losses and now they are not, they are being bailed out by somebody,” said Morgan Ricks, a law professor and financial expert at Vanderbilt University. If this is a good thing or bad thing that is a matter of personal opinion. The government has now come in to secure the deposit including those over the $250,000 threshold. Setting the precedent that any bank can be deemed a systematically important bank and too big to fail. In the short term this will help the economy and calm the storm. In the long term this unleashes Pandora's box.

Balaji’s Bet,

On March 17th Balaji Srinivasan, formerly CTO at Coinbase, entrepreneur, investor, and advocate for cryptocurrencies and blockchain technology tweeted:

He threw down the gauntlet of bitcoin skyrocketing due to the current economic state of the world. Crypto price speculation is something loved by the industry, people make whole careers out of sycophants pumping and dumping but Balaji isn’t some nobody trying to make a buck. His net worth is well into the hundreds of millions. Does he want to just pump up his Bitcoin holdings? Unlikely, he would only benefit if sold to fiat or another coin. Money printing, banks collapsing, and the loss of faith in government organizations are all things that will lead to an exponential adoption of Bitcoin.

Balaji has continued to provide context for the bet over the weeks on twitter and has been unwavering in his conviction. The fall of the US dollar is an absurd concept but when they’re printing an endless supply, not tied to anything, and on a whim pour billions into a failing business it's hard not to be bearish on it.

Don’t dismiss Balaji’s bet for the sake of it being such a drastic increase so fast. Look at the supporting data that justified that line of thinking. Don’t be sycophantic and blindly follow him as well. Research yourself, come to your own conclusion, looking at multiple angles and perspectives. For me I see it as 2008 was the spark that created Bitcoin and 2023 will be what leads to its mass adoption. If Bitcoin will hit 1M in a few months I have no idea.